It’s Time to Heal is a special package about engineering the future of bio and healthcare. See more at: https://a16z.com/time-to-heal/.

And for exclusive access to a downloadable version of this complete deck, sign up for the a16z Bio Newsletter here.

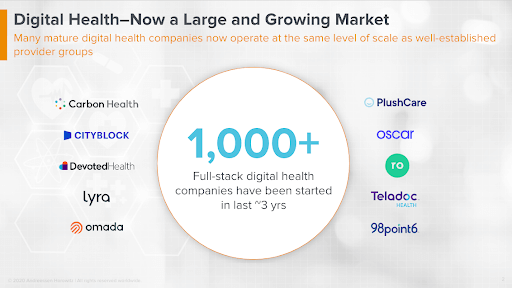

After a record-breaking year for digital health, we’re (finally!) entering into a new golden era for tech-enabled healthcare. There has been an explosion of stand-alone, full-stack digital health startups that take the form of a virtual clinic and compete directly with traditional providers for patients.

Any investments or portfolio companies mentioned, referred to, or described on this page are not representative of all investments in vehicles managed by a16z and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by a16z is available here: https://a16z.com/investments/. Past results of Andreessen Horowitz’s investments, pooled investment vehicles, or investment strategies are not necessarily indicative of future results.

These digital health companies require similar backend infrastructure as traditional providers… but the relevant “healthcare IT” systems make you feel like the 1990’s called, asking for their software back. Not only do they have miserable user experiences, but they were also built during a time when fee-for-service was the dominant way of doing business; when interoperability wasn’t yet a term of art; and when it was inconceivable that patients would be primary end users of these products. So the majority of digital health companies have built their entire tech stack from the ground up, while others are spending lots of time and money to customize off-the-shelf systems to get them to do what they need.

Enabling Digital Health Companies To Bring Their A-Game

The true promise of digital health is the delivery of high-quality care at a fraction of the cost, and at dramatically higher scale than incumbents—by using modern tech and AI to do what historically has been done through human labor or poorly functioning IT products. A risk to this promise is that every digital health company ends up allocating all of its cost savings to rebuilding the same components of their operating systems over and over again from scratch, across their separate walled gardens.

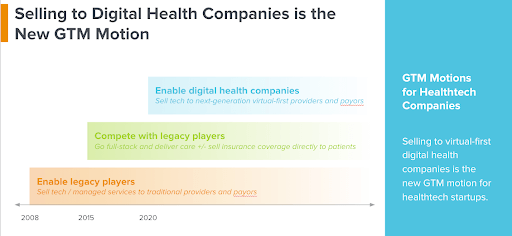

We’re now at a tipping point where the digital health market is large enough, and growing quickly enough, to drive demand for companies that serve as the “new tech stack for virtual-first care.

We’re now at a tipping point where the digital health market is large enough, and growing quickly enough, to drive demand for companies that serve as the “new tech stack for virtual-first care”. In the same way that Plaid abstracted out entire layers of infrastructure to dramatically reduce the cost and and time to stand up a new fintech business, these healthtech companies are allowing digital health startups to accelerate their time-to-market, and shift their focus on building core infrastructure to delivering game-changing care to patients.

Tech Stack Components

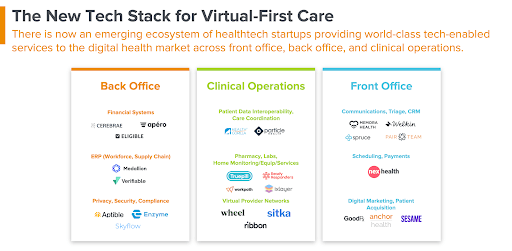

So what comprises the new tech stack for virtual-first care? Digital health companies have infrastructure needs in the following areas:

- Care delivery services: e.g. clinical operations, virtual consults, ancillary services (e.g. labs, pharmacy)

- Back office administration: e.g. revenue cycle, credentialing, supply chain management

- Front office administration: e.g. scheduling, registration, payments and e-commerce, customer engagement

The solutions in these categories are not necessarily software-only; some will provide live operational services with both online and offline aspects. Getlabs, for instance, provides an API that triggers on-demand phlebotomists being sent into people’s homes to conduct sample collection for lab testing. Digital health companies have also been at the tip of the spear of much of the business model innovation occurring across healthcare, which drives the need for capabilities enabling risk-bearing models, recurring revenue streams, and cash pay approaches, as well as provider operations at national scale, versus local. For instance, Medallion offers automated provider credentialing to digital health companies that require telehealth licensure for their clinicians across all 50 states, which has never been a requirement for traditional brick-and-mortar clinics.

Today, each of these categories can be viewed as a micro-service where a digital health company might contract with multiple companies across these categories, or even create redundancy through multiple relationships within a category. In the future, the winners will likely expand their surface area to capture more value within a given box (the same way Truepill has expanded beyond pharmacy into telehealth and lab services).

Characteristics for Success

Product breadth and developer experience will be key to differentiation in this market, along with a clear ROI tied to revenue and margin expansion opportunity for the business. Healthtech companies might consider further strengthening their position in the market by focusing on:

High-volume areas of transactions to engender stickiness. Example: Ribbon focuses on the billions of financial, administrative, and referral transactions that occur every year amongst virtual-first care companies that require some piece of data about physicians.

Connecting multiple stakeholders where integration is non-trivially challenging. It’s the intersections between stakeholders in healthcare that are often the most challenging to build against, but also where network effects can be generated. Example: Eligible connects providers with payors for automated transactions that have historically required faxes and phone calls, and where APIs don’t readily exist.

An executable path for selling to incumbents over time. Eventually, even the legacy players will adopt virtual-first care models, presenting a means to significantly expand the addressable market for these healthtech companies. Example: Wheel’s virtual clinic platform enables digital health companies to build flexible telehealth capacity, but can also be used by incumbent providers and payors as they spin up virtual care programs that may be challenging to staff through traditional means.

Upping the Game on Healthcare Product Quality

One of the biggest benefits of this movement of digital health companies becoming buyers of healthtech is the raising of the quality bar for healthcare products—both in terms of the quality of the technology itself, and that of the end user experiences they enable. At my own startup, which sold software to legacy enterprises, we rarely got credit from our customers for the quality of our products (e.g. user experience, high-scale performance, availability of APIs), while instead being evaluated primarily on things like the ability to integrate with legacy systems, compatibility with established workflows (even if those workflows were not optimized), and compliance, privacy and security—which, while very important, only represent the most basic set of requirements.

Many of the buyers at digital health companies are world class technologists in their own right, have experienced what best-in-class enterprise- and consumer- grade technology looks like in other industries, and won’t settle for anything less in their own tech stack. While the industry has long lamented the crappy user interfaces and performance of legacy healthcare IT systems, the growth in digital health company market share will change that, including for traditional care delivery organizations over time, as they, too, modernize their own ways of doing business.

- Grand Challenges in Healthcare AI with Vijay Pande and Julie Yoo

- Behind the Buy: Payors and Providers on AI Adoption

- The Most Interesting Healthcare Companies You’ve Never Heard Of with Julie Klapstein

- Transitioning from Gymnast to Investor with Aly Raisman

- Finding PMF in Healthcare (After Tasting it Elsewhere) with Eren Bali and Max Cohen